2025: Year of the Trump Shock

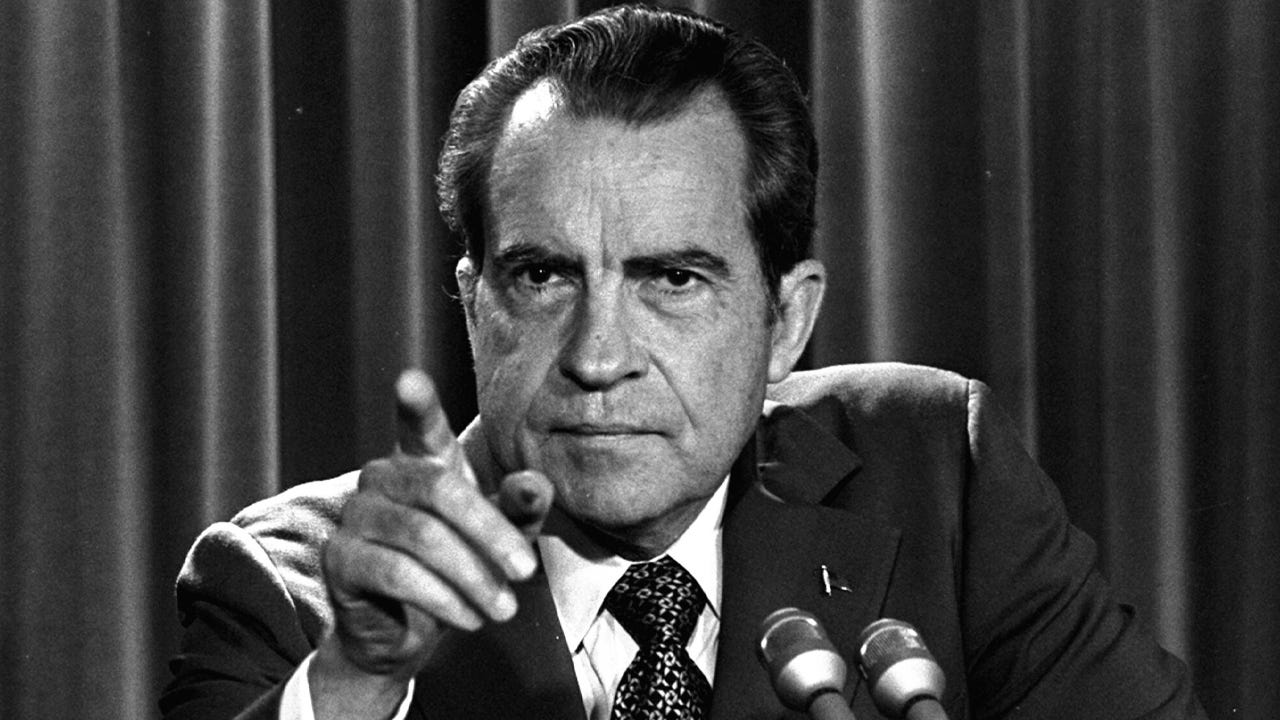

Nixon closed the gold window in 1971, Trump opened the crypto window in 2025

On August 15, 1971, President Richard Nixon appeared on television to announce that America would no longer convert dollars to gold at a fixed rate. In seventeen minutes, he shattered the Bretton Woods system that had governed international finance since World War II. The “Nixon Shock,” as it came to be known, ultimately asserted American power and reshaped global capitalism for the next half-century.

Fifty-four years later, we may have witnessed its sequel. The year 2025 will likely be remembered as the “Trump Shock,” when America aggressively claimed ownership of a new monetary system. Where Nixon closed the gold window to protect American interests, Trump opened the crypto window to assert American control over it. Where Nixon acted defensively to preserve dollar hegemony, Trump moved offensively to extend it into the age of computing and networks.

Nixon’s decision took decades to fully manifest, ultimately enabling the financialization of the global economy. Trump’s crypto pivot might compress that timeline from fifty years to five, potentially leading to the tokenisation of not just money but every asset class on earth—with America, improbably, holding the conductor’s baton.

The Architecture of Disruption

The Trump Shock didn’t arrive with a single television address but through a coordinated legislative blitzkrieg that insiders now call “Crypto Week.” In July 2025, Congress passed three interlocking pieces of legislation that transformed America from crypto skeptic to crypto champion in the span of days. Each bill was a pillar in a larger structure designed to make the US, in Trump’s characteristically modest phrasing, “the crypto capital of the world.”

The GENIUS Act, signed on July 18, established the first comprehensive federal framework for payment stablecoins. The Genius Act was an architectural reimagination rather than a simpler incremental reform. By creating uniform licensing paths and supervision requirements, it enabled stablecoins to move away from regulatory gray zones into legitimate financial infrastructure. With it the message to the world became unmistakable: dollar-backed stablecoins were now an instrument of American monetary sovereignty and its newest export.

The Anti-CBDC Surveillance State Act took an even bolder stance. By explicitly prohibiting the Federal Reserve from issuing a direct-to-consumer Central Bank Digital Currency (also called retail CBDC), Congress made a fascinating gambit. Rather than compete with China’s digital yuan through a government-controlled “Fedcoin,” America would franchise its digital currency to private enterprise. Let Beijing have its surveillance coin; Washington would have a thousand flowers bloom, each one denominated in dollars.

Finally, the CLARITY Act completed the trifecta by statutorily classifying decentralised tokens like Bitcoin as commodities rather than securities. This single classification eliminated years of regulatory uncertainty and legal battles that had so far pushed crypto activities offshore. Overnight, building crypto businesses in America went from navigating a minefield to following a roadmap. And with this, crypto talent started relocating back to the continent.

Together, these three acts did more than provide regulatory clarity; they made a philosophical statement about the future of money. While other nations treated digital currencies as tools for government control or instruments of speculation, America treated them as instruments of private enterprise. While others feared disruption, America embraced acceleration.

The Gold Rush in Pinstripes

If legislation set the framework, markets supplied the validation. In the second half of 2025, crypto companies surged from the periphery to the heart of global finance.

Circle’s initial public offering in June 2025 legitimised an entire industry. The company behind USDC, the second-largest stablecoin, priced its shares at $31—already above expectations. By day’s end, Circle’s stock had surged 168%, creating more wealth in eight hours than most companies generate in decades. The market had finally recognised what stablecoins represented: the privatisation of money itself.

Then the floodgates opened. eToro went public in May, Bullish in August, and Gemini and Figure Technology Solutions in September. Each listing built on the last, creating a feedback loop of legitimacy. When BitGo filed its IPO papers and both Kraken and Consensys announced 2026 listing plans, the message was clear: crypto had moved from the fringe of venture capital to the heart of Wall Street.

Bitcoin also played a role in this mainstream embrace. In early October 2025, it surpassed $126,000, breaking a psychological barrier that shifted it from speculative asset to portfolio staple. The SEC’s approval of standardized listing rules for spot crypto ETFs further accelerated adoption, cutting approval times to 75 days and paving the way for ETFs covering everything from Solana to multi-asset baskets.

The rapid succession of IPOs and regulatory approvals left little doubt: crypto had moved from experiment to infrastructure. Traditional financial institutions now treated it as a core asset class, and market participants adjusted accordingly.

The Presidential Grift as Feature, Not Bug

No account of the Trump Shock would be complete without addressing its most controversial element: the Trump family’s direct participation in the markets they were reshaping through regulation, using their position to advance their own interests.

Keep reading with a 7-day free trial

Subscribe to Currency of Power to keep reading this post and get 7 days of free access to the full post archives.